Big Update: BISP 8171 Payments Shifted to Bank Accounts – ATM Withdrawals Started

BISP 8171 Payments Shifted to Bank Accounts

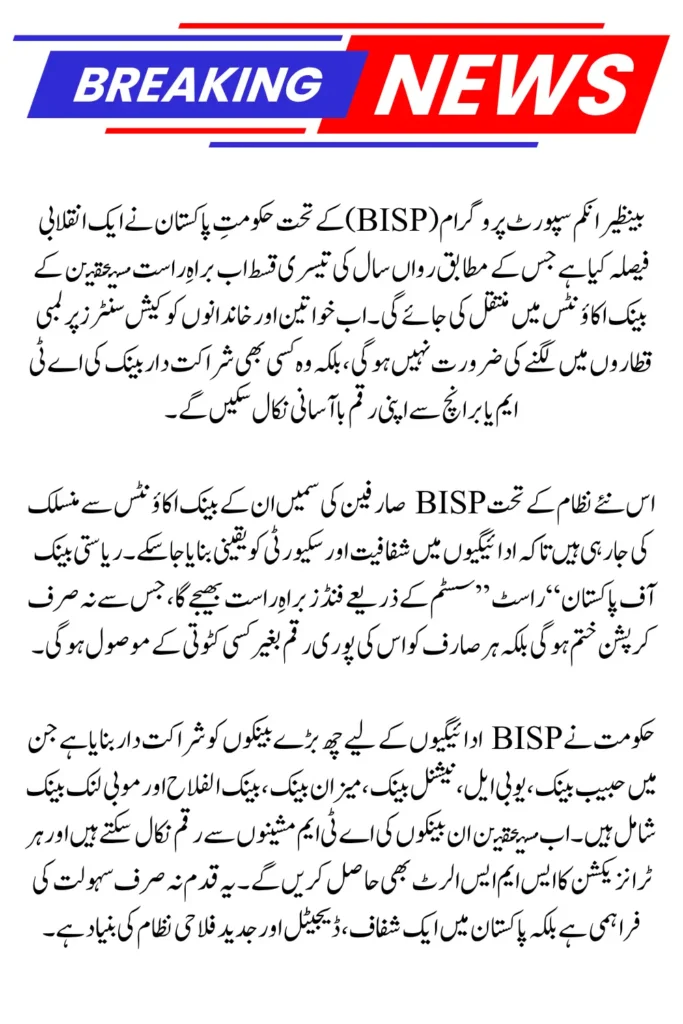

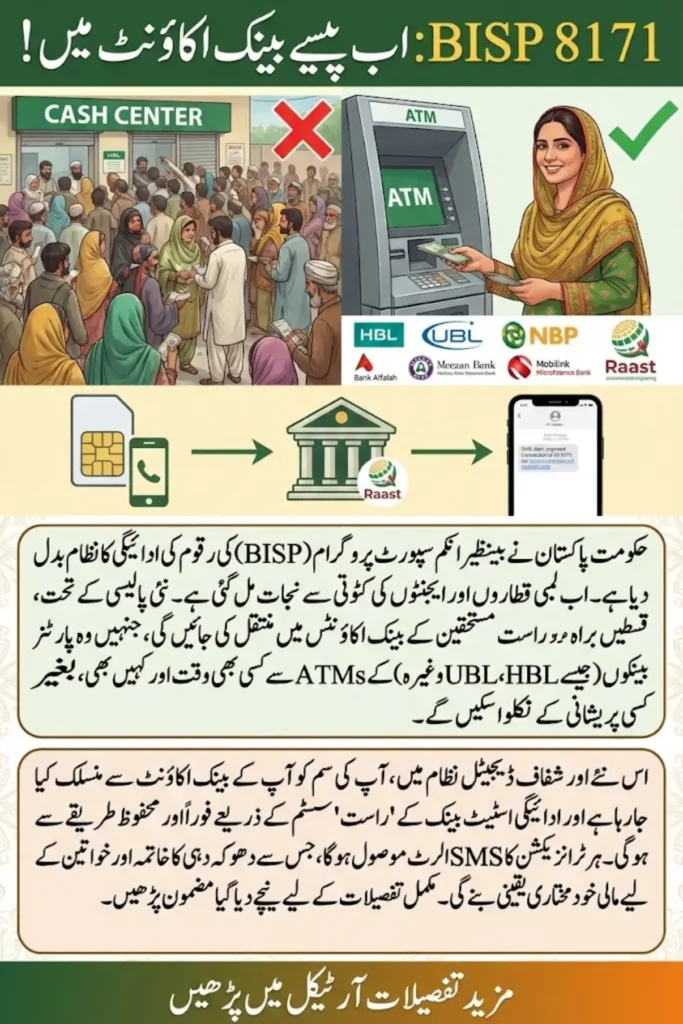

The Government of Pakistan has introduced a new and improved system for distributing financial assistance under the Benazir Income Support Program (BISP). According to the latest decision made in the National Assembly’s Poverty Alleviation Committee, beneficiaries will now receive their payments directly into their bank accounts instead of through cash centers.

This new policy aims to make the process faster, transparent, and corruption-free, allowing women and low-income families to access funds easily from ATMs or bank branches anywhere in Pakistan.

8171 Benazir Income Support Program 2026: How to Check, Verify, and Collect Your Installment

What Is Changing in BISP Payments

Previously, BISP payments were distributed through specific payment centers or retail agents, which often caused long queues, system delays, and deductions by middlemen.

Now, the third installment of 2026 will be digitally transferred to the beneficiaries’ bank accounts. Nearly 80% of BISP beneficiaries will benefit from this direct transfer system. This step brings Pakistan closer to a cashless and transparent welfare system, using modern banking and IT infrastructure.

Decision Made in National Assembly Meeting

The official announcement was made during a meeting chaired by Ghulam Ali Talpur, the head of the committee.

The BISP Secretary briefed the members that:

- All BISP users’ SIM cards will be linked with their bank accounts.

- Payments will be transferred through the Raast system of the State Bank of Pakistan.

- The government is also in talks with NADRA to reduce service charges for verification and registration.

These changes are expected to make the payment process secure, efficient, and transparent.

Imam Masjid Support Program 2026: Monthly Stipend Initiative for Mosque Leaders in Punjab

Integration of SIMs with Bank Accounts

One of the major reforms in the new system is the integration of users’ SIM cards with their bank accounts.

The Ministry of Information Technology has started issuing new SIMs for BISP beneficiaries. Once linked, these SIMs will allow beneficiaries to receive SMS alerts for every transaction, helping them stay updated on their balance and ensuring that no one else can misuse their funds.

This digital link will act as a security layer, protecting users from fraud or unauthorized withdrawals.

How to Get a MEPCO eOps New Connection After ENC Closure

Role of the State Bank and Raast Payment System

The State Bank of Pakistan (SBP) will directly handle the fund transfers through Raast, Pakistan’s national instant payment system.

Raast allows the government to send payments instantly and securely without involving third-party agents. Each transaction will be recorded digitally, ensuring that beneficiaries receive their full amount without any deductions or delays.

This is the first time that a government social welfare program in Pakistan is being fully integrated with digital banking infrastructure.

BISP Partner Banks for ATM Withdrawals

Under the new payment method, BISP has partnered with six major banks across Pakistan to facilitate easy withdrawals.

Below is a detailed table of partner banks and their available withdrawal options:

| Sr. No. | Partner Bank Name | Withdrawal Method | Facilities Available |

|---|---|---|---|

| 1 | Habib Bank Limited (HBL) | ATM & Bank Branch | 24/7 ATM access, SMS balance check |

| 2 | United Bank Limited (UBL) | ATM & Bank Branch | Mobile app support, easy cash withdrawal |

| 3 | National Bank of Pakistan (NBP) | Branches (ATMs in progress) | Manual withdrawal from counter |

| 4 | Bank Alfalah | ATM & Branch | Debit card and digital wallet options |

| 5 | Meezan Bank | ATM & Branch | Islamic banking option, SMS updates |

| 6 | Mobilink Microfinance Bank | Mobile App & Agent Network | Biometric verification, easy account setup |

This partnership ensures that BISP beneficiaries can withdraw their money anytime and anywhere, reducing dependency on specific payment centers.

BISP Phase 2 Payments 2026: How to Check Eligibility and Receive Rs. 13,500

How to Withdraw BISP Payment from ATM

Beneficiaries can withdraw their BISP payments easily using any of the above banks’ ATMs. Below is a step-by-step guide:

- Visit any nearby ATM of one of the six partner banks.

- Insert your BISP Debit Card (if issued) or use your CNIC-based access option where available.

- Select “BISP Account” or “G2P (Government to Person)” option on the ATM screen.

- Enter your CNIC number and PIN code for verification.

- Choose Withdraw Cash and enter the amount.

- Collect your money and confirmation receipt.

- You’ll receive an SMS alert on your registered SIM confirming the transaction.

This process is simple, transparent, and secure removing the need for intermediaries or extra charges.

Benefits of the New BISP Banking System

The new system brings numerous advantages for both the government and the beneficiaries:

- Direct Deposit: Payments go directly to the beneficiary’s bank account no middlemen involved.

- 24/7 Access: Funds can be withdrawn at any time through ATMs.

- Transparent Tracking: Each transaction is recorded through the Raast system.

- SMS Alerts: Beneficiaries get instant payment notifications.

- Reduced Corruption: No agent deductions or fake entries.

- Financial Inclusion: Encourages rural women to open and manage bank accounts.

- Nationwide Access: Can withdraw from any partner bank, not just assigned locations.

This system is designed to empower women, promote digital literacy, and strengthen financial inclusion across Pakistan.

Pension Updates in Pakistan 2026: What Retirees Need to Know

Efforts to Reduce Service Charges

The BISP Secretary also confirmed that discussions with NADRA are underway to reduce verification and service fees.

The goal is to make registration and identity verification more affordable, ensuring that low-income families do not face additional costs.

The government is also developing a helpline and mobile app support system where users can check their payment status, update their bank information, and locate the nearest partner bank.

Future Goals of BISP Digitalization

With this new digital banking system, BISP aims to achieve the following goals by 2026:

- 100% of payments transferred digitally through banks.

- Biometric verification for all beneficiaries.

- Integration with Raast and NADRA databases for full transparency.

- Introduction of Benazir Debit Card for every registered woman.

- Elimination of all cash-based distribution centers.

This initiative will make Pakistan’s social welfare system one of the most transparent in South Asia.

CNIC Registration in NSER: A Complete Guide for Government Assistance in Pakistan

Common Questions About BISP ATM Withdrawals

Q1: Can I withdraw BISP payment from any bank ATM?

➡ Yes, if the bank is one of the six partner banks (HBL, UBL, NBP, Bank Alfalah, Meezan Bank, or Mobilink Bank).

Q2: Do I need a bank account for BISP payment?

➡ Yes. The new system transfers payments directly to your personal bank account.

Q3: What if my SIM is not linked to my bank account?

➡ You must visit your bank or the nearest BISP office to update your SIM information for security purposes.

Q4: Can I check my payment online?

➡ Yes, you can check it through the BISP portal or the partner bank’s mobile app.

Conclusion

The BISP ATM Withdrawals Partner Banks initiative is a transformative step toward a more digital, transparent, and secure welfare system in Pakistan.

By linking SIM cards, using the Raast payment system, and partnering with major banks, the government is ensuring that every deserving citizen receives their full payment without hassle or corruption.

This digital transformation is not just about convenience it’s about empowering millions of women and families to take control of their finances and build a better future.

YOU CAN ALSO READ: 8123 Ramzan Rashan Scheme 2026 Complete Eligibility, Registration, and Benefits Guide