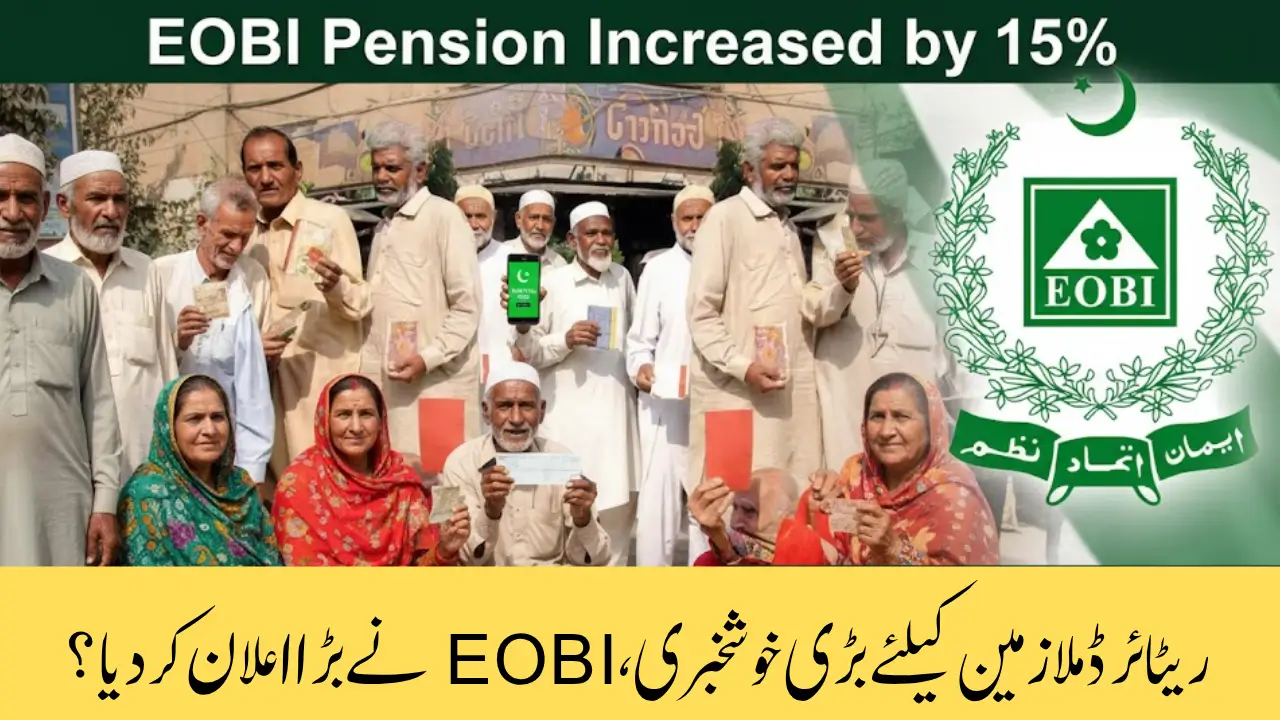

Good News EOBI Increased Pension for Retired Pakistani Workers In 2026 Complete Details Explained

EOBI Increased Pension: The Employees’ Old-Age Benefits Institution (EOBI) has delivered exceptional news for retired workers in 2026. With a strong commitment to ensuring financial security and dignified retirement for private-sector employees, EOBI has introduced several reforms this year.

These updates not only promise higher pension amounts but also improve transparency through CNIC-based verification and expanded worker coverage, making the system more inclusive and efficient than ever before.

What is EOBI and How Does It Work?

EOBI (Employees’ Old-Age Benefits Institution) operates under a government mandate to protect the rights of private-sector workers in Pakistan. Established to provide retirement, disability, and survivors’ benefits, the institution collects contributions from both employers and employees to maintain a sustainable pension fund.

This social protection scheme ensures that after years of service, workers are rewarded with a guaranteed monthly income, offering peace of mind during their golden years.

Key Points:

- Funded through shared contributions

- Provides pensions for retirees, disabled workers, and dependents of deceased employees

- Supervised by the Ministry of Overseas Pakistanis and Human Resource Development

EOBI Pension 2026: Key Highlights

2026 has brought major updates to the EOBI system, reflecting the government’s aim to strengthen social welfare.

Highlights include:

- 15% increase in all EOBI pensions effective february 31, 2026

- Minimum monthly pension raised from Rs. 10,000 to Rs. 11,500

- Senior contributors may now earn up to Rs. 30,000 per month

- CNIC-based verification system introduced for fraud prevention

- Wider coverage now includes informal sector workers

These reforms make 2026 a historic year for EOBI pensioners and applicants alike.

EOBI Pension Eligibility Criteria for 2026

To qualify for EOBI Pension in 2026, applicants must meet the following conditions:

Registration Through Employer

Applicants must be registered under EOBI through their official employer, ensuring proper documentation and contribution tracking.

Age and Service Requirements

- Men: 60 years or older

- Women: 55 years or older

- Minimum contribution period: 15 years

Non-Eligibility Factors

- Applicants already receiving another government pension cannot claim EOBI benefits.

- Incomplete or unverified contribution records may lead to disqualification.

Updated CNIC-Based Verification System 2026

To eliminate fraudulent claims, EOBI now requires all applicants to undergo CNIC-based identity verification.

Verification process includes:

- Submitting CNIC details during application

- Cross-checking employment and contribution history via NADRA-integrated systems

- Confirmation email or SMS notification upon successful verification

This digital approach ensures faster approvals and reduces the risk of data manipulation.

How to Claim Your EOBI Pension in 2026

The process of claiming your EOBI pension is simple and transparent. Follow these four steps carefully:

Step 1: Gather Required Documents

Before submitting your claim, ensure you have:

- Valid CNIC

- EOBI contribution record

- Completed Pension Claim Form (PE-02 or A-6)

- Two passport-size photos

- Employer’s service certificate

- Bank account details for pension deposit

Step 2: Submit Application

You can submit your pension claim:

- In-person at your nearest EOBI regional office

- Online through the EOBI official portal (where available)

Ensure all details match your CNIC to avoid processing delays.

Step 3: Verification and Approval

After submission, EOBI officials will verify your:

- Age

- Employment history

- Contribution records

Once approved, you’ll receive an official confirmation notice.

Step 4: Start Receiving Pension

Your pension will be directly deposited into your registered bank account each month, providing consistent financial support.

EOBI Pension Increase in 2026

As of January 2026, EOBI pensions have increased by 15%.

| Category | Previous Pension | New Pension (2026) |

|---|---|---|

| Minimum | Rs. 10,000 | Rs. 11,500 |

| Average | Rs. 15,000 | Rs. 17,250 |

| Maximum | Rs. 25,000 | Rs. 30,000 |

This boost ensures pensioners can better cope with inflation and rising living costs.

Expansion of Coverage for Informal Workers

For the first time, EOBI aims to include informal and semi-formal sector workers such as:

- Domestic helpers

- Agricultural laborers

- Daily wage earners

This initiative aims to expand EOBI’s reach and bring social protection to millions previously left out of the system.

Benefits of EOBI Pension for Senior Citizens

EOBI provides more than just a monthly payment it’s a lifeline for Pakistan’s retired workforce.

Major Benefits:

- Guaranteed monthly income after retirement

- Legal protection under the government’s supervision

- Accessible services through online portals and regional offices

- Survivor pension for the dependents of deceased contributors

- Encourages long-term savings and worker welfare

Pro Tips for a Smooth EOBI Pension Application

Follow these recommendations for a hassle-free process:

- Keep your CNIC and EOBI registration updated

- Verify contribution records yearly

- Maintain copies of all submitted documents

- Apply online for faster processing

- Contact EOBI helpline for assistance

Common FAQs about EOBI Pension 2026

What is the new minimum pension amount in 2026?

The minimum monthly EOBI pension is now Rs. 11,500.

Can private company employees apply?

Yes, any registered private-sector employee under EOBI can apply after completing the required service period.

How long does the application process take?

Usually between 30–60 days, depending on verification speed.

Can EOBI pension be claimed online?

Yes, through the EOBI online portal, where available.

Is CNIC verification mandatory?

Absolutely. Without CNIC verification, your claim cannot be processed.

Can a widow receive pension benefits?

Yes, widows and dependents of deceased contributors are eligible for survivor’s pension.

Conclusion

EOBI Pension 2026 stands as a milestone reform for Pakistan’s retired community. The increase in benefits, digital verification, and inclusion of informal workers mark a progressive step toward nationwide financial security.

For official forms, updates, and verification, visit the EOBI official website.