How EOBI Pension Boost 2026 Can Improve Your Retirement Income in Pakistan

How EOBI Pension Boost

How EOBI Pension Boosts The Employees’ Old-Age Benefits Institution (EOBI) has launched the Pension Boost 2026 to provide additional financial support to retired employees in Pakistan. Rising living costs and inflation have made it challenging for retirees to manage daily expenses, and this initiative aims to ensure financial stability and independence for senior citizens. With improved digital verification and streamlined application processes, the program has been designed to make pension access faster, more transparent, and hassle-free.

YOU CAN ALSO READ: BISP PMT Score Check by CNIC 2026: What Every Family Must Verify Now

Understanding the EOBI Pension Boost

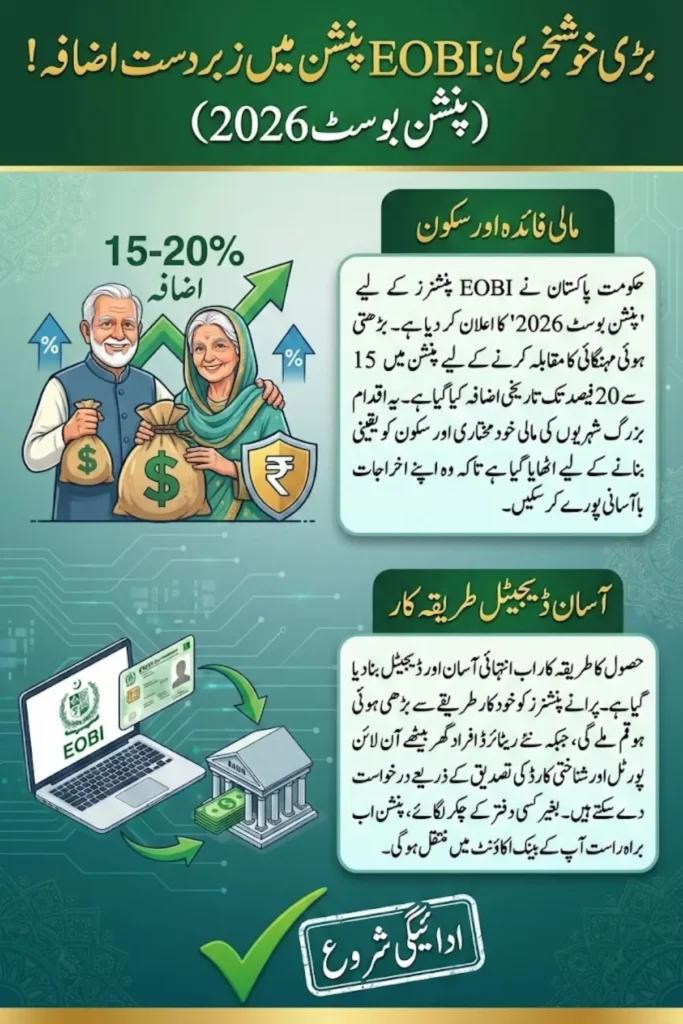

The EOBI Pension Boost 2026 represents the government’s effort to strengthen the social security system. Existing pensioners automatically receive the revised amount, while new retirees need to verify their eligibility and submit relevant documents. The increase in pension payouts is designed to align with current economic trends and inflation rates, helping retirees maintain their standard of living.

Eligibility Requirements

To qualify for the enhanced pension, retirees must meet specific conditions set by the EOBI. These requirements ensure that the benefits are distributed fairly and reach those who have contributed to the system over the years. The key eligibility criteria include:

- Being a registered EOBI contributor for the minimum required duration

- Attaining the age of 60 or older

- Completing CNIC verification and submitting the required documentation

- Having no outstanding compliance issues with past contributions

Meeting these conditions guarantees that retirees receive the full benefits of the revised pension program.

YOU CAN ALSO READ: BISP CNIC Check 2026: Step-by-Step Guide to Verify Your Registration Fast

Pension Boost Features

The EOBI Pension Boost offers several features aimed at improving the financial situation of retired workers. These benefits are designed to simplify the process and make the system more efficient.

| Feature | Details |

|---|---|

| Eligibility | Registered contributors aged 60 and above |

| Required Documents | CNIC, employment record, pension application form |

| Pension Increase | 15–20% depending on contribution history and previous pension |

| Application Method | Online verification through the official EOBI portal |

| Disbursement | Direct bank transfer to ensure timely payments |

| Purpose | Support retirees in managing essential expenses |

| Key Benefit | Promote financial independence and reduce reliance on family support |

The structured increase in pension allows retirees to cover healthcare, utilities, groceries, and other necessary living expenses more comfortably.

Applying for the Pension Boost

The application process has been simplified through online channels to ensure quick and transparent service. Retirees can submit their documents and verify past contributions directly through the EOBI portal. This digital approach reduces delays, prevents errors, and eliminates the need for physical paperwork.

Steps to apply include:

- Visit the official EOBI portal

- Submit CNIC and the completed pension application form

- Verify past contribution records

- Receive confirmation of the updated pension amount

By adopting online verification, the EOBI ensures that retirees can access their benefits without unnecessary complications.

YOU CAN ALSO READ: Punjab Government Announces Farmers to Get Rs20,000/acre and Families Up to Rs1 Million via CM Relief Card

Advantages for Retirees

The increase in the monthly pension provides several advantages for retired employees. First, it helps cover the rising costs of daily living, including healthcare and utility bills. It also reduces dependency on family members, giving retirees a greater sense of independence and financial security. Many beneficiaries report improved confidence and peace of mind as a result of the boost.

Financial Planning Tips

With the enhanced pension, retirees can take steps to manage their finances more effectively. Some strategies include:

- Adjusting monthly budgets to reflect the new pension amount

- Allocating a portion of funds for emergency savings

- Utilizing government health and social support programs for additional assistance

Proper financial planning ensures retirees can enjoy a comfortable lifestyle and make the most of the increased pension benefits.

YOU CAN ALSO READ: How to View PM Laptop Scheme 2026 Application Status (via CNIC)

FAQs

Many retirees have questions about the new pension structure. Some common queries include:

- How much will the pension increase?

The boost generally ranges between 15–20%, depending on contribution history and previous pension amounts. - Can new retirees access the increased pension?

Yes, once they meet the eligibility criteria and complete CNIC verification. - Is CNIC verification mandatory?

Yes, this step ensures accurate allocation of funds and prevents fraudulent claims.

The EOBI’s digital system has made it easier for retirees to find answers and complete necessary steps without visiting offices physically.

Long-Term Outlook for EOBI Pensions

The 2026 pension boost is a key step toward a more sustainable and modern social security system. Future adjustments are expected to consider inflation and demographic changes to maintain the financial stability of retirees. Additionally, further digital improvements are planned to ensure faster processing and timely pension disbursement. The initiative sets a benchmark for future reforms that aim to enhance the quality of life for Pakistan’s retired workforce.

Conclusion

The EOBI Pension Boost 2026 provides meaningful support to retired employees, ensuring they can maintain financial independence and meet essential expenses. Through online verification, a simplified application process, and increased monthly payouts, retirees are empowered to plan their finances effectively. This program reflects the government’s commitment to modernizing social security and highlights the importance of continuous improvements to support the aging population in Pakistan.

YOU CAN ALSO READ: Punjab 8070 Ramzan 2026 Cash Grant Explained Full PSER Registration, Eligibility, and Payment Breakdown