Mera Ghar Mera Ashiana Loan Scheme Started By SBP – How to Get Rs 20 Lakh To 35 Lakh with 10-Year Subsidy

Mera Ghar Mera Ashiana Loan Scheme

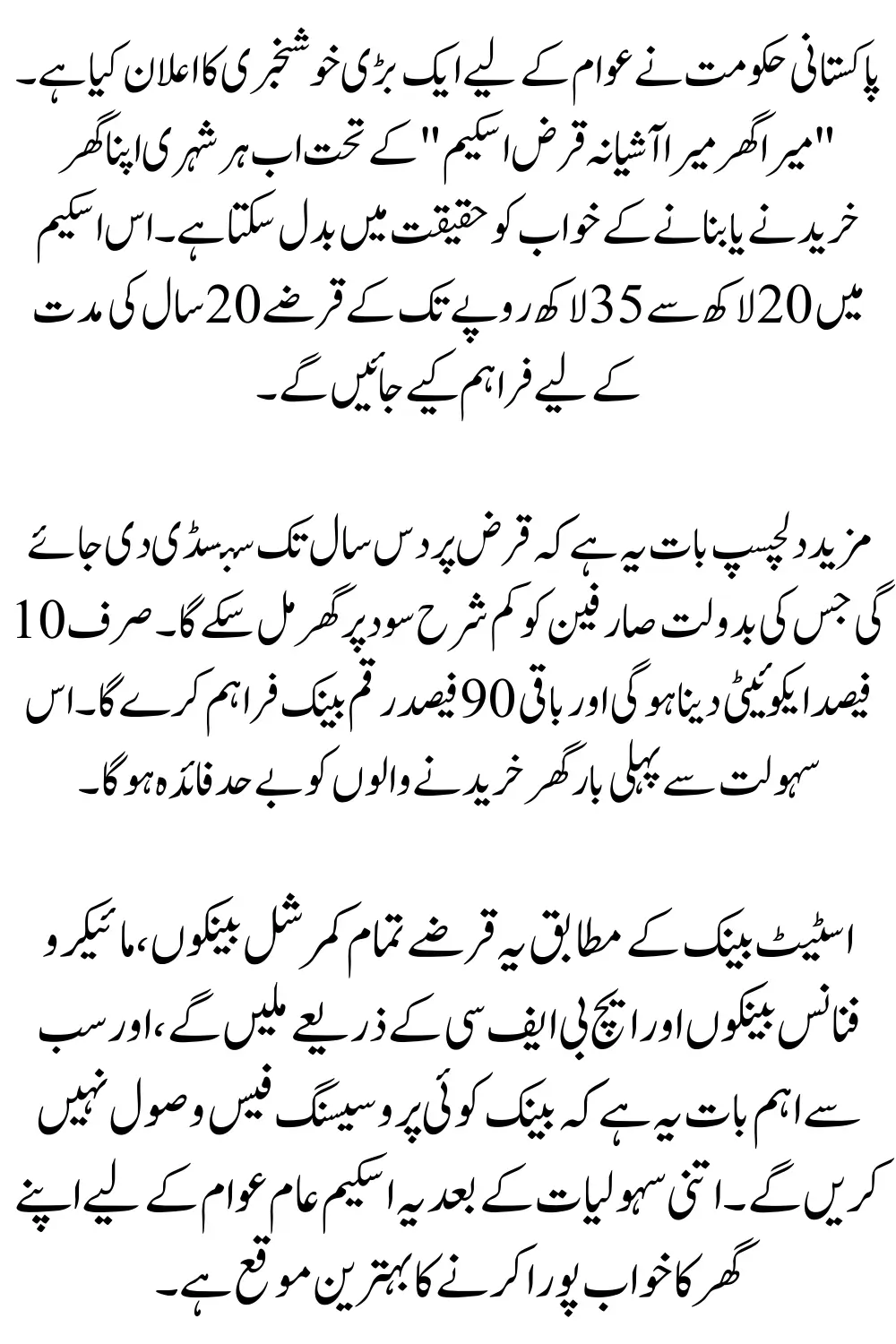

The Government of Pakistan has introduced the Mera Ghar Mera Ashiana loan scheme to help citizens buy or build their first home. Under this program, loans between PKR 2 million and PKR 3.5 million are available with a repayment period of up to 20 years. The scheme also offers a 10-year subsidy on the loan, making it easier for families to afford their own house.

This initiative has been officially announced by the State Bank of Pakistan (SBP), and the loans will be available through commercial banks, microfinance banks, and HBFC.

What is the Mera Ghar Mera Ashiana loan?

The Mera Ghar Mera Ashiana loan is a government-backed housing finance scheme designed for first-time homebuyers in Pakistan. It provides affordable financing with lower interest rates, risk-sharing support, and no hidden processing charges.

This loan can be used for:

- Buying a house or flat

- Purchasing a plot and building on it

- Constructing or completing your own home

Quick Facts About Mera Ghar Mera Ashiana Loan

- Loan Amount: PKR 2,000,000 (20 lakh) to PKR 3,500,000 (35 lakh)

- Tenor: Up to 20 years

- Subsidy: 10 years

- Pricing: Bank pricing at KIBOR + 3%

- Fixed Rates for Borrower:

- PKR 2 million loan → 5% fixed rate

- PKR 3.5 million loan → 8% fixed rate

- Loan-to-Value (LTV): 90% loan, 10% equity from borrower

- Processing Charges: None

Who Can Apply for the Mera Ghar Mera Ashiana Loan?

Eligibility is simple and clear:

- Applicant must be a Pakistani citizen with a valid CNIC

- Only first-time homebuyers can apply

- Minimum 10% equity contribution is required

- Applicants must provide proof of income (salary slip or bank statement)

Property Uses Under the Scheme

The Mera Ghar Mera Ashiana loan can be used for different housing needs, including:

- Buying a new or used house/flat

- Purchasing a plot and building on it

- Constructing a new home on your own land

- Completing an under-construction house

How to Apply for the Mera Ghar Mera Ashiana Loan

The application process is simple and available across Pakistan. You can apply through:

- Commercial banks

- Microfinance banks

- House Building Finance Corporation (HBFC)

Step-by-Step Process:

- Visit your nearest bank branch that offers this scheme.

- Fill out the Mera Ghar Mera Ashiana loan application form.

- Submit your CNIC, income proof, and property details.

- The bank will review your documents and process your request.

- Once approved, the loan will be disbursed directly.

Understanding Loan Pricing (KIBOR + 3%)

Banks will price this loan at KIBOR + 3%, but for the borrower, the government provides a subsidy that keeps the effective rate fixed for the first 10 years.

- For loans up to PKR 2 million → 5% fixed rate

- For loans up to PKR 3.5 million → 8% fixed rate

This means you can enjoy affordable monthly installments, and after 10 years, normal pricing rules will apply.

Example of Loan Repayments

Here’s a simple example to understand how this scheme reduces your cost:

- Loan of PKR 2,000,000 at 5% for 20 years → Affordable monthly installment with government subsidy.

- Loan of PKR 3,500,000 at 8% for 20 years → Higher loan amount but still with reduced markup.

This shows that the scheme helps middle-class families manage their dream of owning a home.

Required Documents for Application

To apply for the Mera Ghar Mera Ashiana loan, you will need:

- Copy of CNIC

- Salary slip or bank statement (proof of income)

- Property documents (house/flat/plot)

- Application form from the bank

FAQs About Mera Ghar Mera Ashiana Loan

Tips Before Applying

- Confirm your eligibility as a first-time homebuyer.

- Ask your bank for clear details about loan pricing after the 10-year subsidy ends.

- Compare offers from different banks before finalizing.

- Always keep copies of all submitted documents.

Conclusion

The Mera Ghar Mera Ashiana loan is a golden opportunity for first-time buyers in Pakistan. With affordable financing of up to PKR 3.5 million, a 10-year subsidy, and no processing fees, it is designed to make home ownership easier for families. If you meet the eligibility criteria, visit your nearest bank or HBFC branch and start your application today.