Mera Ghar Mera Ashiana Scheme Online Registration- Eligibility, Criteria and Other Details

Mera Ghar Mera Ashiana Scheme Online Registration

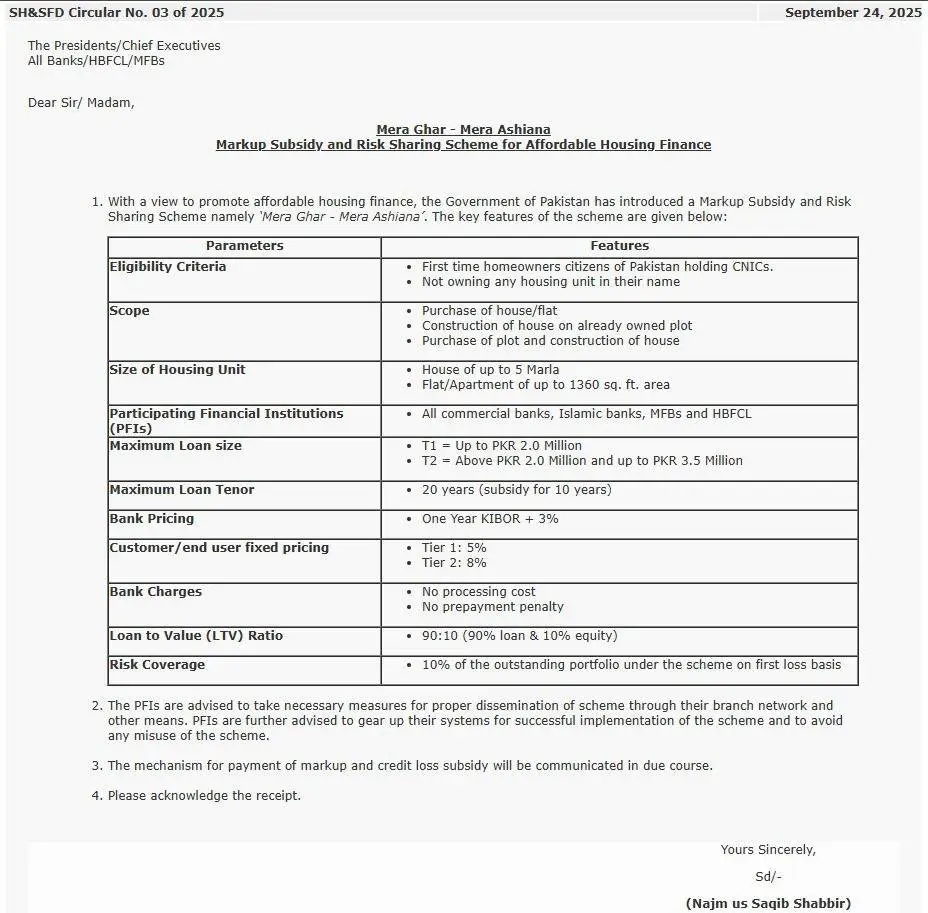

The Government of Pakistan has launched the Mera Ghar Mera Ashiana Scheme Online Registration Process for citizens, which provides easy loans for buying or constructing a house, flat, plot. The loan amount will be between Rs 2 million and Rs 3.5 million, the repayment will be in 20 years, and a 10-year government subsidy is also available. The loan will require only 10% equity and banks will not charge processing charges.

This scheme is only for first-time home buyers, and the interest rate has been kept low: 5% on Rs 2 million and 8% on Rs 3.5 million. All banks, microfinance institutions and HBFCs will provide loans, and the application process is easy and fast online. Learn more and read the full article for a complete guide to your dream home.

What is Mera Ghar Mera Ashiana Scheme?

The Mera Ghar Mera Ashiana Scheme is a government-backed housing loan program aimed at supporting ordinary citizens in purchasing or building their homes. The State Bank of Pakistan (SBP) oversees the program and ensures smooth loan distribution through banks, microfinance institutions, and the HBFC.

| Feature | Details |

|---|---|

| Scheme Name | Mera Ghar Mera Ashiana Scheme |

| Purpose | Provide loans for buying/building houses, flats, and plots |

| Loan Amount | PKR 20 lakh – PKR 35 lakh |

| Loan Tenure | 20 years |

| Government Subsidy | 10 years |

| Interest Rate | 5% for PKR 20 lakh, 8% for PKR 35 lakh |

| Equity Requirement | 10% by applicant, 90% covered by loan |

| Eligibility | First-time homebuyers |

| Participating Institutions | All commercial banks, microfinance institutions, HBFC |

| Processing Charges | None |

| Application Method | Online application via bank or HBFC |

This scheme provides financial assistance with low-interest rates and long repayment periods, making it easier for citizens to achieve homeownership.

Loan Amount and Terms

Under this scheme, eligible applicants can avail loans ranging from PKR 20 lakh to PKR 35 lakh. The loan repayment period is 20 years, while the government provides a 10-year subsidy to reduce the financial burden.

The interest rates are highly affordable:

- PKR 20 lakh loan: 5% interest rate

- PKR 35 lakh loan: 8% interest rate

Applicants are required to provide 10% equity, and the remaining 90% will be covered by the loan. Banks will not charge any processing fees for these loans, making it even more accessible.

Eligibility Criteria

To qualify for the Mera Ghar Mera Ashiana Scheme, applicants must meet the following conditions:

- Must be a first-time homebuyer.

- Should have the ability to contribute 10% equity towards the home.

- Must provide necessary documents as proof of identity, income, and residence.

This scheme is primarily aimed at helping citizens who have never owned a home before.

Participating Banks and Loan Disbursement

The loans under this scheme are distributed through:

- All commercial banks in Pakistan

- Microfinance institutions

- House Building Finance Corporation (HBFC)

The State Bank of Pakistan ensures that the process is transparent and free of hidden charges. Banks will offer loans with simple procedures and zero processing fees, making it easier for applicants to complete the registration and loan process.

Mera Ghar Mera Ashiana Scheme Online Registration Process

Applying for the Mera Ghar Mera Ashiana Scheme is simple and can be done online:

- Visit the official website of your participating bank or HBFC.

- Fill out the online application form with personal and financial details.

- Upload required documents, including CNIC, proof of income, and property details.

- Submit the form and wait for the bank’s approval.

- Once approved, the loan will be disbursed directly to your account or property seller.

Benefits of the Scheme

- Affordable Homeownership: Low interest rates (5%–8%) and 20-year repayment period.

- Government Subsidy: 10-year subsidy reduces the financial burden.

- No Processing Fees: Banks will not charge extra fees for processing loans.

- Support for First-Time Buyers: Focused on helping citizens who have never owned a home.

Conclusion

The Mera Ghar Mera Ashiana Scheme is a golden opportunity for first-time homebuyers in Pakistan. With affordable loans, long repayment terms, and government support, owning a home has never been easier. Interested citizens should apply online and take advantage of this valuable initiative to secure their dream home today.