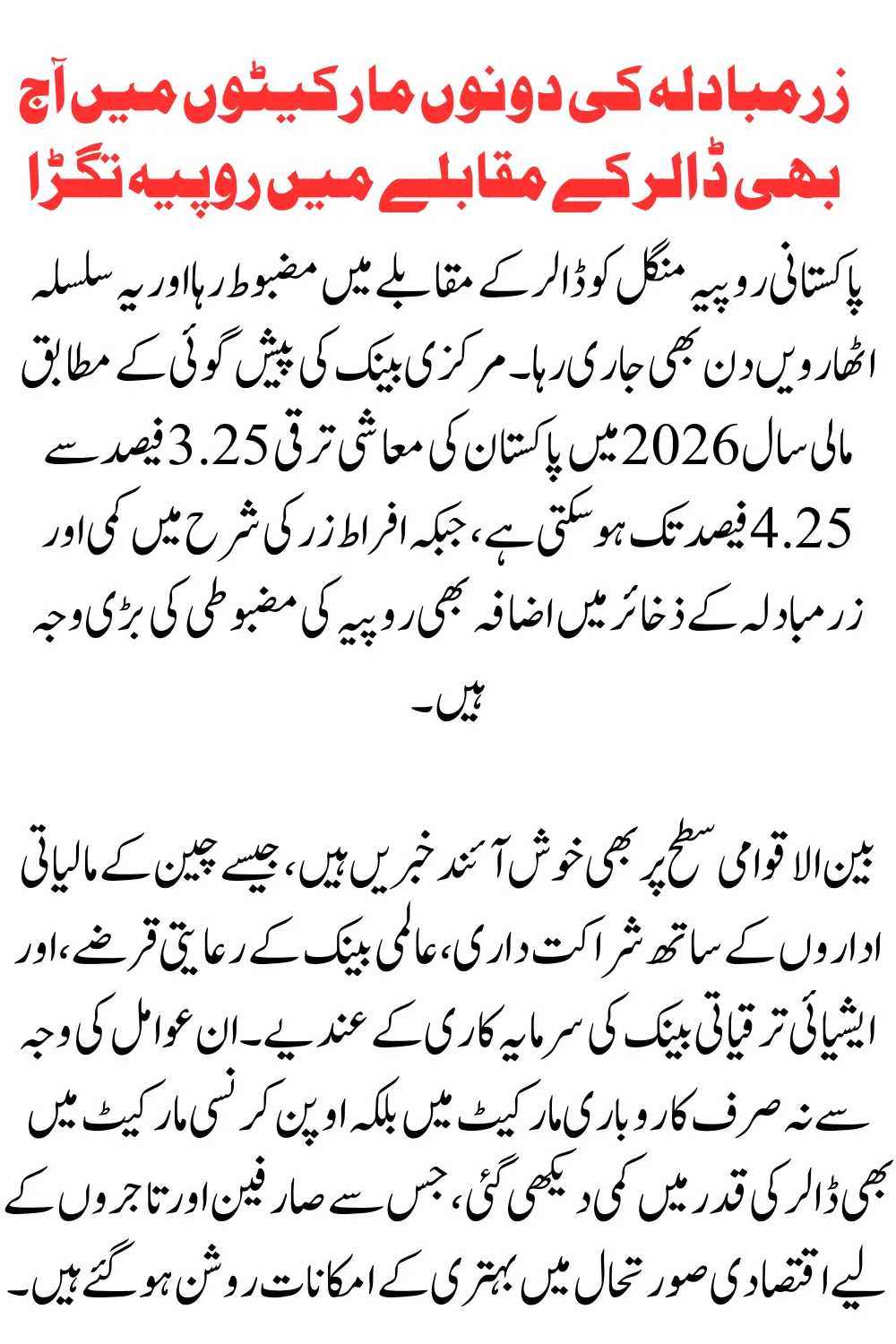

Pakistani Rupee Strengthens Against Dollar Forex Market Update September 2026

Pakistani Rupee Strengthens Against Dollar

The Pakistani rupee strengthened against the dollar on Tuesday, continuing its 18th day of gains. The central bank has forecast Pakistan’s economic growth to be 3.25 percent to 4.25 percent in fiscal year 2026, while a decline in inflation and an increase in foreign exchange reserves are also major reasons for the rupee’s strength.

There is also good news at the international level, such as partnerships with Chinese financial institutions, concessional loans from the World Bank, and indications of investment from the Asian Development Bank. Due to these factors, the dollar’s value was seen to decline not only in the business market but also in the open currency market, which has brightened the prospects of improving the economic situation for consumers and traders.

Why the Rupee is Gaining Strength

Several factors are contributing to the strengthening of the Pakistani Rupee. According to the central bank, the country is expected to see economic growth of 3.25% to 4.25% in the financial year 2026. At the same time, inflation rates are expected to decline, which enhances consumer purchasing power and business confidence.

| Indicator | Tuesday Movement | Details / Remarks |

|---|---|---|

| Exchange Market Dollar Rate | ↓ 3 paisa | Opened lower by 28 paisa at PKR 281.47, closed at PKR 281.72 due to import demand |

| Open Currency Market Dollar Rate | ↓ 17 paisa | Closed at PKR 283.40 |

| Economic Growth (FY 2026) | 3.25% – 4.25% | Projected by the central bank |

| Inflation Rate | Decreasing | Supports currency stability |

| Remittances (FY 2026) | $40 billion | Major boost to foreign exchange reserves |

| Payment Capacity (Current FY) | PKR 1.8 billion | Ensures import and financial stability |

| International Support | World Bank & ADB | Concessional loans and investment indications |

| Chinese Partnerships | Active | Strengthens economic confidence |

In addition, an increase in foreign exchange reserves is providing additional support for the currency. These combined factors are playing a crucial role in maintaining stability in both official and open currency markets.

Recommended For You: 120000 BISP Taxpayers Benefited Audit Report Reveals Payments To Ineligible People

Impact of Remittances and Payment Capacity

The central bank predicts that remittances will reach $40 billion in FY 2026, providing a major boost to the country’s foreign exchange reserves. The current financial year has already shown a strong ability to manage payments, with payment capacity reaching PKR 1.8 billion.

This inflow of remittances ensures that Pakistan can meet its import demands while maintaining currency stability, which directly affects the strength of the rupee against the dollar.

Role of International Financial Partnerships

International financial support has also positively influenced the rupee. Pakistan has strengthened partnerships with Chinese financial institutions, which provide access to funding and investment opportunities.

Additionally, the World Bank has offered concessional loan packages, and the Asian Development Bank has indicated potential investments. These international collaborations enhance confidence in Pakistan’s economy and help stabilize the foreign exchange market.

Recommended For You: New Nokia X200 Ultra Revealed 200MP Camera and Massive 18100mAh Battery Know Full Details About Price

Currency Market Movements

On Tuesday, the exchange market saw the dollar fall by 28 paisa, reaching PKR 281.47 at one point. However, due to import demand, the dollar closed at PKR 281.72, reflecting a net decline of 3 paisa.

In the open currency market, the dollar also declined by 17 paisa, closing at PKR 283.40. These trends show that the rupee is maintaining strength across different market channels, although import activity can influence minor fluctuations.

Outlook for the Pakistani Rupee

The overall outlook for the Pakistani Rupee remains positive. With economic growth projections, declining inflation, rising foreign exchange reserves, and strong international financial support, the currency is expected to continue performing well.

Businesses, investors, and consumers can remain cautiously optimistic as the rupee’s strength reflects improving economic stability. Monitoring currency market trends in the coming weeks will be essential, especially as import demands and global financial developments continue to influence market behavior.

Recommended For You: Pakistani Rupee Strengthens Against Dollar Forex Market Update September 2026

Conclusion

The Pakistani Rupee’s performance against the dollar highlights a period of stability and growing investor confidence. Strong economic indicators, rising remittances, and strategic international partnerships have all contributed to this positive trend. While minor fluctuations due to imports are expected, the rupee is well-positioned to maintain its strength in the near future.