SBP Circular Mera Ghar Mera Aashiana Scheme 2026 Official Low-Markup Home Loans (PKR 20–35 Lakh)

SBP Mera Ghar Mera Aashiana Scheme

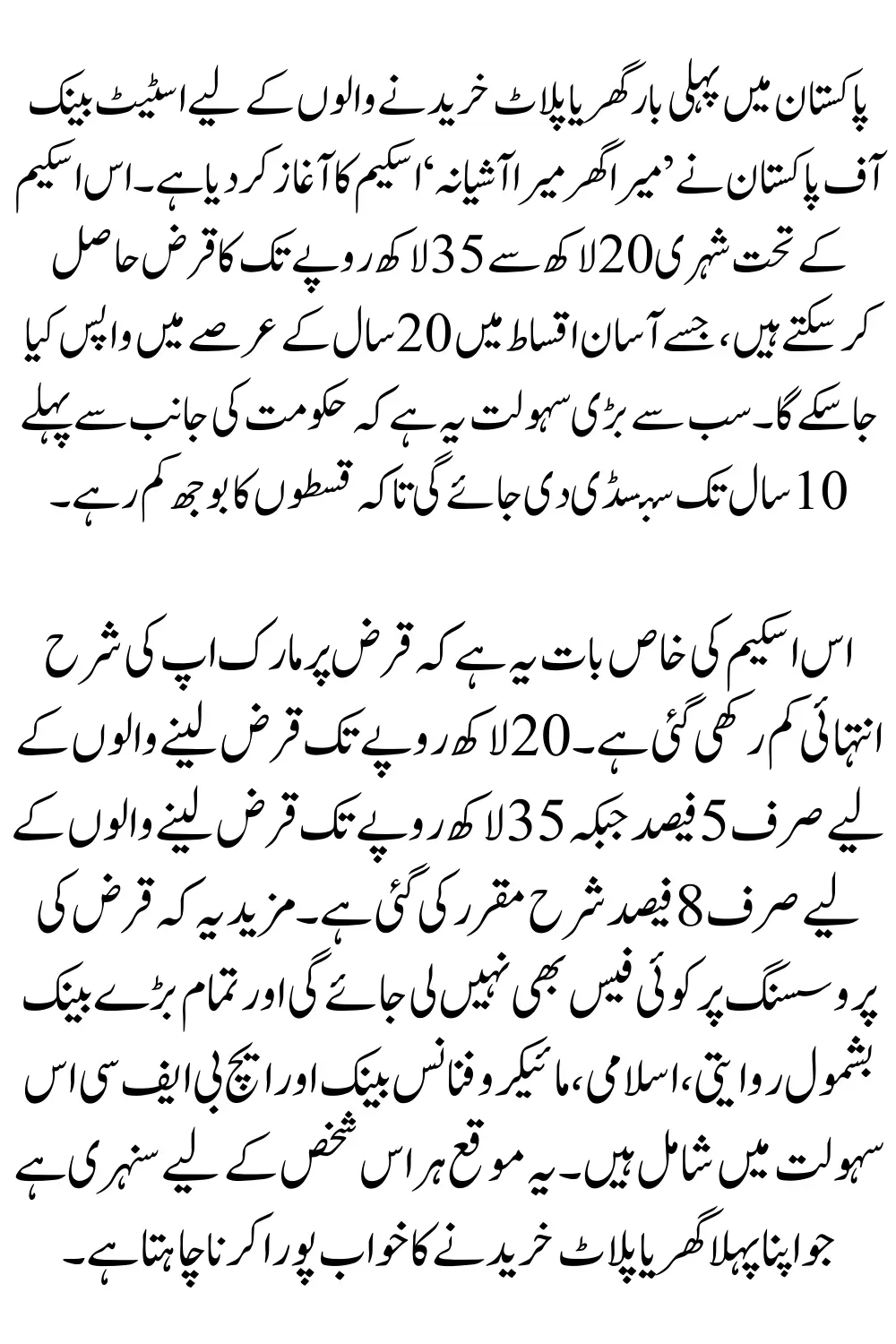

Owning a home is a dream for many Pakistanis, and now it is becoming easier with the State Bank of Pakistan’s Mera Ghar Mera Aashiana Scheme 2026. This scheme has been specially launched to help first-time home buyers purchase or construct their own house, flat, or plot with affordable loans. The loan amount ranges between PKR 20 lakhs to PKR 35 lakhs with a repayment period of up to 20 years.

This initiative is designed to make housing accessible for families who have never owned a house before. With low markup rates and zero processing fees, it is considered one of the most attractive housing finance opportunities in Pakistan.

Objective of SBP Mera Ghar Mera Aashiana Scheme

The main goal of the Mera Ghar Mera Aashiana Scheme is to make home ownership possible for low and middle-income families in Pakistan. Rising property prices have made it difficult for people to buy their first home. This scheme ensures that families can purchase or build a house with the support of long-term financing and a government-backed subsidy for up to 10 years.

Eligibility for First-Time Buyers

This scheme is only for individuals or families who are buying their first home. Anyone who already owns a house or has previously taken a home loan is not eligible. Applicants must:

- Be Pakistani citizens.

- Apply for their first-ever house, flat, or plot.

- Show proof of income to ensure loan repayment ability.

By targeting first-time buyers, the government ensures that housing is made accessible to those who genuinely need it.

Loan Amount Range

Under this scheme, borrowers can get a loan amount between PKR 20,00,000 (20 lakhs) to PKR 35,00,000 (35 lakhs).

- If you need a smaller loan (up to 20 lakhs), you will enjoy lower markup rates.

- For a larger loan (up to 35 lakhs), slightly higher rates will apply but still remain affordable compared to market loans.

This makes the scheme flexible, catering to both small and medium-level housing needs.

Loan Duration and Subsidy Procedure

One of the most attractive features of the scheme is its long repayment period of 20 years. This allows borrowers to repay their loan in smaller monthly installments instead of facing financial stress.

Additionally, the government will provide a subsidy for the first 10 years, making it easier for families to manage payments in the initial years of ownership.

Interest/Markup Rates – Easy Breakdown

The markup rates under the Mera Ghar Mera Aashiana Scheme 2026 are very affordable compared to normal bank loans:

- Up to PKR 20 lakhs loan → 5% markup rate

- Up to PKR 35 lakhs loan → 8% markup rate

All banks will calculate the loan pricing based on KIBOR + 3%, but the customer will only pay the fixed subsidized markup mentioned above. This makes the scheme highly cost-effective.

Participating Banks

The State Bank of Pakistan has ensured that this scheme is widely available. Loans will be provided through:

- Conventional Banks

- Islamic Banks

- Microfinance Banks

- House Building Finance Corporation (HBFC)

Applicants can approach any of these banks to apply for the scheme.

SBP Mera Ghar Mera Aashiana Scheme Application Process

Here’s a simple step-by-step guide to applying:

- Visit your nearest participating bank branch.

- Request the Mera Ghar Mera Aashiana Scheme 2026 loan form.

- Submit required documents (CNIC, proof of income, property details).

- Bank will review and verify your documents.

- After approval, the loan amount will be released for purchase or construction.

The best part is that there is no processing fee, so applicants don’t need to worry about extra charges.

Benefits of SBP Mera Ghar Mera Aashiana Scheme

This scheme comes with several benefits for citizens:

- First-time buyers can finally own a home.

- Long repayment duration (20 years).

- Subsidized markup rates of 5% and 8%.

- Zero processing fees.

- Wide availability through multiple banks.

- Government-backed support for 10 years.

Key Points to Remember

- Only first-time buyers are eligible.

- Loan amount is between 20 lakhs and 35 lakhs.

- Repayment period is 20 years.

- Subsidy applies for 10 years.

- Available at both conventional and Islamic banks.

Final Thoughts

The Mera Ghar Mera Aashiana Scheme 2026 is a golden opportunity for families who want to buy or build their first home. With easy terms, low markup rates, and no hidden charges, it is one of the most affordable housing schemes in Pakistan.

If you are planning to purchase your first house, flat, or plot, this scheme could be the perfect solution for you. Don’t miss the chance to apply and turn your dream of owning a home into reality.