How to Apply & Qualify: SBP e-bike Loan Scheme 2025 – Complete Guide

SBP e-bike loan scheme 2025

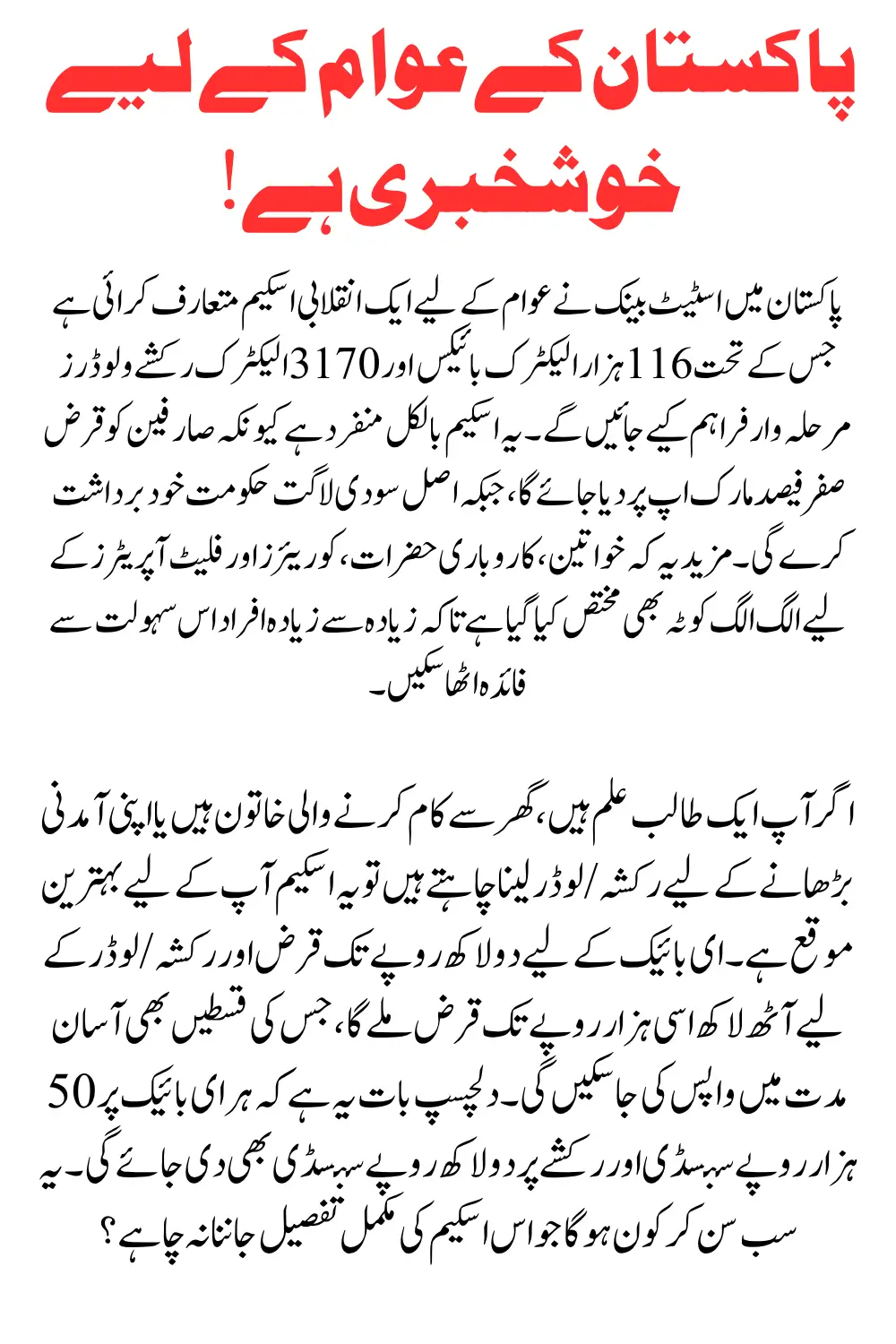

The State Bank of Pakistan (SBP) has launched a historic initiative to provide interest-free financing for electric bikes, rickshaws, and loaders. This program, officially called the SBP e-bike loan scheme, is designed to make transportation cheaper, reduce fuel dependency, create jobs, and support women, couriers, and small businesses.

Under this scheme, more than 116,000 e-bikes and 3,170 electric rickshaws/loaders will be provided in two phases. For the first time, borrowers will enjoy zero markup on loans, as the government will cover the financing cost.

In this article, we’ll explain everything you need to know about the SBP e-bike loan scheme: eligibility, quotas, loan amounts, subsidies, application process, repayment examples, FAQs, and official sources.

What the SBP e-bike loan scheme covers

The scheme will run in two phases. Here’s the breakdown:

| Phase | E-Bikes | E-Rickshaws/Loaders | Total Vehicles |

|---|---|---|---|

| Phase 1 | 40,000 | 1,000 | 41,000 |

| Phase 2 | 76,000 | 2,170 | 78,170 |

| Total | 116,000 | 3,170 | 119,170 |

This large-scale rollout makes it one of the biggest clean-transport initiatives in Pakistan.

SBP e-bike loan scheme: Loan amounts, tenors & markup

- Loan for e-bikes: up to PKR 200,000

- Loan for e-rickshaws/loaders: up to PKR 880,000

- Tenor (repayment period):

- E-bikes: 2 years

- E-rickshaws/loaders: 3 years

- Markup: Banks will finance at KIBOR + 2.75%, but the government will pay this cost, so the borrower receives the loan at 0% markup.

In simple words: you will only repay the principal amount in easy installments no extra interest!

Subsidy & financing structure in SBP e-bike loan scheme

The scheme has an additional subsidy to make loans more affordable:

- PKR 50,000 subsidy per e-bike

- PKR 200,000 subsidy per rickshaw/loader

Most loans will follow an 80:20 debt-to-equity ratio, but the subsidy will cover part (or all) of the equity, so many applicants won’t need to pay heavy down payments.

Who is eligible for the SBP e-bike loan scheme?

To apply, you must meet the following conditions:

- Pakistani citizen with valid CNIC.

- Age limit: 18 to 60 years.

- No loan default history with any bank or microfinance institution.

- Ability to repay installments (can be through salary, small business income, courier work, or ride-sharing).

- Special quotas for:

- Women: 25% of total e-bikes.

- Couriers/businesses: 10% of e-bikes.

- Fleet operators: 30% of rickshaws and loaders.

Required documents & application process for SBP e-bike loan scheme

Documents you need:

- Copy of valid CNIC

- Passport-size photographs

- Proof of income (salary slip, business income statement, courier ID, or any verifiable source)

- Proof of residence (utility bill, rental agreement, or domicile)

- Mobile number registered on your CNIC

Step-by-step application process:

- Visit the official SBP portal or participating bank branch.

- Fill out the loan application form for the SBP e-bike loan scheme.

- Submit required documents.

- Choose your preferred e-bike, rickshaw, or loader from the approved list of dealers.

- Bank verifies your details and applies subsidy.

- Loan is disbursed directly to the dealer, and you get delivery of your vehicle.

How Priority Quotas are Allocated

The scheme ensures fair distribution:

- 25% e-bikes reserved for women to encourage mobility, education, and empowerment.

- 10% e-bikes reserved for couriers/business operators to support Pakistan’s growing delivery and gig economy.

- 30% of e-rickshaws and loaders reserved for fleet operators to create jobs and enhance transport networks.

Repayment examples: SBP e-bike loan scheme calculator

Let’s look at two simple repayment scenarios:

Example A: E-Bike

- Loan: PKR 200,000

- Subsidy: PKR 50,000 (final financed amount = PKR 150,000)

- Tenor: 24 months (2 years)

- Monthly installment = ~PKR 6,250

Example B: E-Rickshaw

- Loan: PKR 880,000

- Subsidy: PKR 200,000 (final financed amount = PKR 680,000)

- Tenor: 36 months (3 years)

- Monthly installment = ~PKR 18,889

These numbers are approximate; actual payments may vary slightly depending on bank terms.

Where to apply for the SBP e-bike loan scheme

- You can apply through Islamic and conventional banks approved by SBP.

- The scheme will also be available on the official SBP website and designated e-portal (PAVE).

- Authorized dealerships will be listed to prevent fraud and ensure warranty/after-sales support.

Pros & cons: Is the SBP e-bike loan scheme right for you?

Pros:

- Zero markup loans (no extra interest).

- Huge subsidies reduce the upfront cost.

- Special quotas for women and businesses.

- Environment-friendly, fuel-saving transport.

Cons:

- Battery replacement costs after 2–3 years.

- Charging infrastructure still limited in many cities.

- Application rejection possible if documents are incomplete.

Impact of the SBP e-bike loan scheme

This scheme will:

- Reduce petrol and diesel dependency.

- Provide affordable mobility to students, women, and workers.

- Support couriers and ride-hailing jobs.

- Reduce carbon emissions and improve air quality in cities.

FAQs about the SBP e-bike loan scheme

What is the SBP e-bike loan scheme?

It’s a government-backed program by the State Bank of Pakistan to provide interest-free loans for e-bikes, e-rickshaws, and loaders.

How many vehicles will be financed?

A total of 116,000 e-bikes and 3,170 e-rickshaws/loaders in two phases.

How much loan can I get?

Up to PKR 200,000 for e-bikes and PKR 880,000 for rickshaws/loaders.

What is the repayment period?

2 years for e-bikes, 3 years for rickshaws/loaders.

Do I need to pay markup?

No. The government pays markup you repay only the principal.

Is there a subsidy?

Yes. PKR 50,000 subsidy for e-bikes and PKR 200,000 for rickshaws/loaders.

Who gets priority in this scheme?

Women (25%), couriers/business users (10%), and fleet operators (30% for rickshaws/loaders).

How can I apply?

Through SBP’s official portal or participating banks with required documents.

Can unemployed people apply?

Yes, but you must show repayment ability (e.g., through courier/gig work).

When does the scheme start?

Phase 1 is starting in 2025; further rollout dates will be announced by SBP.

Final thoughts

The SBP e-bike loan scheme is a game-changer for Pakistan. By offering zero markup loans with subsidies, it helps thousands of citizens especially women, couriers, and small business owners access affordable, eco-friendly transport.

If you’re looking for a cost-effective way to own an electric bike, rickshaw, or loader, this is the best opportunity in years. Start preparing your documents and apply as soon as the official registration portal opens.